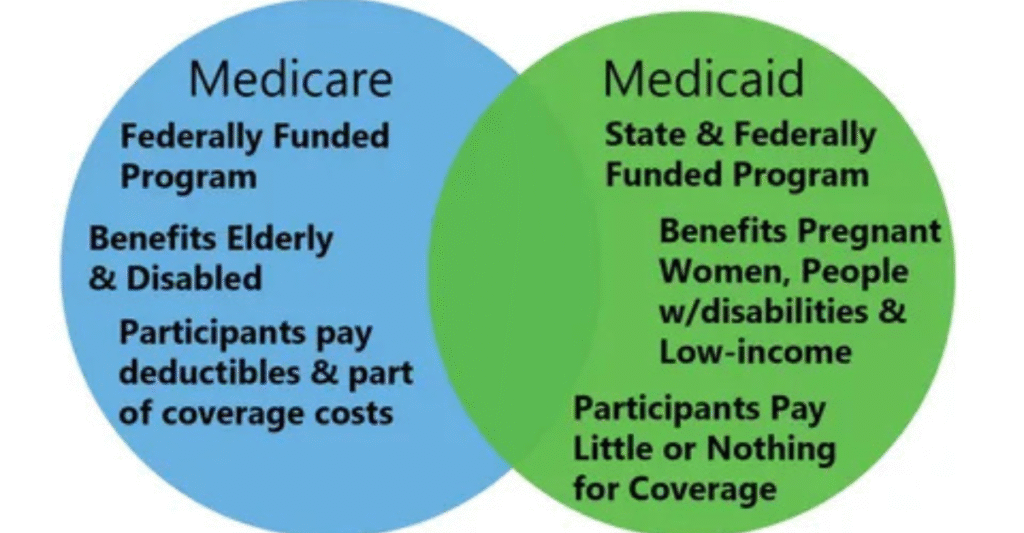

Will Medicaid Cover Out-of-State Emergencies? This is useful to know if one travels, moves from state to state, or needs medical help outside the home. Medicaid is a health coverage that offers help to low-income families, the elderly, children, and disabled individuals.

But it’s run by individual states, so the rules are varied where you Medicaid emergency coverage emergency coverage out-of-state emergency coverage This is confusing when you’re in a crisis elsewhere. You have to know what counts as an emergency, what Medicaid will pay for, and when you will have to pay. This book explains all this in simple terms with real-life examples.

General Medicaid Coverage Rules

Medicaid is not a national program. It is handled in each state by federal regulations. That means your Medicaid policy is generally limited to providers in your home state. Every state also has its own network of hospitals, doctors, and clinics who will take Medicaid. If you go out-of-state on a regular basis, Medicaid will not generally cover the cost.

But federal law requires all Out-of-state Medicaid coverage programs to cover care in certain circumstances. Those are hard-and-fast regulations that target emergencies. If your life or health is at risk, your Medicaid ought to still cover you. The idea is straightforward. No one should be denied lifesaving treatment because they happen to be out of state.

Emergency Coverage Rules Across State Lines

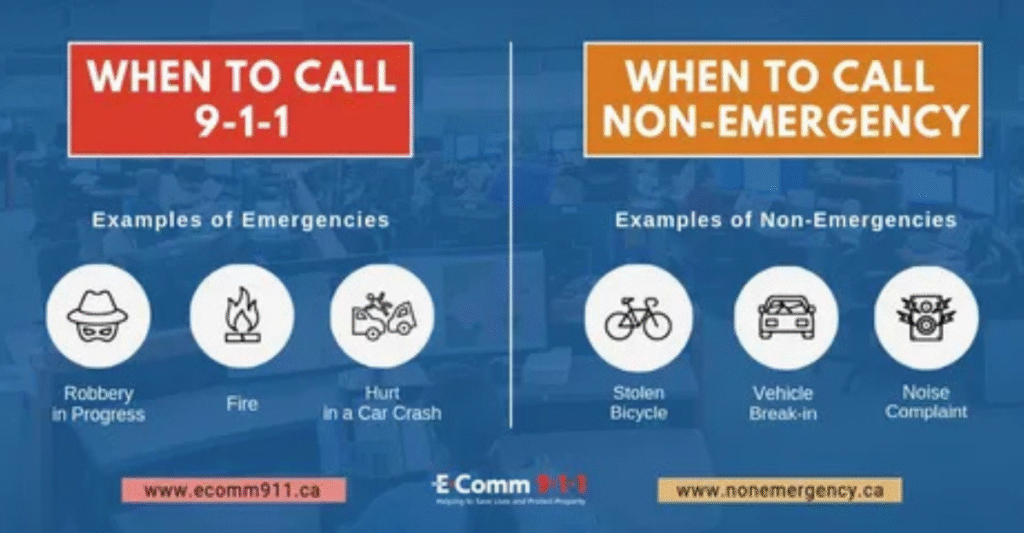

Federal law instructs states to provide medical treatment in emergency situations even if it occurs outside your home state. But under Medicaid, the term “emergency” has a very specific meaning. It is not anything urgent whatsoever. It means a condition that puts your health, life, or body in serious risk if it is not treated immediately.

These events include a stroke, heart attack, or automobile accident. It may also translate to loss of function, like instant blindness, or extreme pain that indicates a life-threatening issue. “Medicaid out-of-state emergency coverage The states may differ in their adherence to this rule, but the federal requirement is still imposed. If the case is life-threatening, then Medicaid is required to cover the treatment.

YOU WILL LIKE: https://doctorambulance.com/what-is-emergency-override-how-it-works-why-it-matters-and-when-it-saves-lives/

Examples of Emergencies Medicaid Typically Covers

For the sake of explanation, here are a few examples of the particular emergencies Medicaid generally pays for when you’re in another state. If you have a stroke while traveling to see family members, Medicaid covers the hospitalization. If you break your leg in a car accident on vacation, Medicaid must cover the emergency surgery.

Other situations are acute illnesses like appendicitis, asthma attack requiring emergency breathing therapy, and pregnancy conditions like preterm labor. They are not routine or elective treatments. They are salvaging cases. The interventions in most situations cannot be delayed until you return to your home state.

Common Emergencies Covered by Medicaid Out-of-State

| Emergency Type | Example Conditions | Covered by Medicaid |

| Heart-related issues | Heart attack, severe chest pain | Yes |

| Accidents & injuries | Car crash, broken bones | Yes |

| Severe illness | Appendicitis, sepsis, asthma | Yes |

| Pregnancy complications | Miscarriage, preterm labor | Yes |

| Sudden organ failure | Kidney failure, stroke | Yes |

Non-Emergency Out-of-State Care

Whereas Medicaid would cover genuine emergencies, it typically does not pay for non-emergency care.“Does Medicaid cover out-of-state emergencies?” Doctor visits when you are feeling fine, dental cleaning, or regular medication beyond your home state are not covered. Medicaid assumes you will use your home state’s network of providers.

There are a couple of exceptions. Occasionally, your state Medicaid will grant prior authorization for care in another state when there is no provider within your state that can provide that care. An example might be a child who has a rare condition and must go see a specialist who only practices in another state. “Medicaid out-of-state emergency coverage There are some states that also have border agreements so individuals who live close to state borders can visit providers over the border.

Documentation & Proof Requirements

Hospitals and doctors must show that your case was a real emergency in order for Medicaid to pay. They usually write an “emergency certification” that proves the situation met Medicaid’s emergency definition. Without this proof, your claim may be denied.

It also helps if you notify your home Medicaid office as soon as possible after treatment. Keep all records, bills, and hospital notes.“Does Medicaid cover out-of-state emergencies?” These documents show what happened and why care was needed immediately. In many states, providers are required to file directly with Medicaid, but having your own paperwork speeds things up.

Special Circumstances to Know

Children covered by the Children’s Health Insurance Program (CHIP) may have different rules. Some states allow wider coverage for kids when out-of-state. Another factor is whether you are in a Managed Care plan or a Fee-for-Service plan. Managed Care networks are stricter and may require you to return to in-state providers once you are stable.

Native American tribal members may also have different coverage rules. Some tribal agreements allow services across multiple states. Knowing these special cases can save you trouble when traveling or moving.

Practical Tips for Medicaid Travelers

Whereas Medicaid would cover genuine emergencies, it typically does not pay for non-emergency care. Doctor visits when you are feeling fine, dental cleaning, or regular medication beyond your home state are not covered. Medicaid assumes you will use your home state’s network of providers.

There are a couple of exceptions. Occasionally, your state Medicaid will grant prior authorization for care in another state when there is no provider within your state that can provide that care. An example might be a child who has a rare condition and must go see a specialist who only practices in another state.“Medicaid out-of-state emergency coverage There are some states that also have border agreements so individuals who live close to state borders can visit providers over the border.

Traveler’s Medicaid Checklist

| Step | Action |

| 1 | Carry Medicaid card at all times |

| 2 | Know emergency hospitals near destination |

| 3 | Keep state Medicaid office contact info |

| 4 | Notify Medicaid office after emergency |

| 5 | Save bills and medical records |

Costs You May Still Face

Each state operates Medicaid under federal law, but the specifics vary. One state might permit some exceptions to border care, while another wouldn’t approve them at all. Some states render approval for out-of-state specialists promptly, but others wait weeks or months.

This implies that your experience varies with your home state. For instance, Texas Medicaid is very restrictive when it comes to non-emergency treatment outside Texas, whereas Out-of-state Medicaid coverage New York is more lenient for children under CHIP. Always visit your state’s Emergency medical coverage under Medicaid website prior to traveling.

READ MORE: https://doctorambulance.com/what-is-an-emergency-action-plan-a-complete-guide/

State-to-State Medicaid Differences

Each state administers Medicaid under federal regulations, but the specifics vary. One state might grant some exceptions for border care, and another will refuse them outright. Some quickly approve out-of-state specialists, while others take weeks or months.

That depends on your home state. Texas Medicaid, for instance, has stringent regulations on non-emergency care outside the state of Texas, whereas New York operates with greater leeway on children under CHIP. Always review your state’s Medicaid website prior to traveling.

Case Studies: Real-Life Situations

Case studies demonstrate what Medicaid coverage is like in the real world. Take Sarah, an Ohio mother, who experienced premature labor while traveling in Florida. Her Medicaid plan paid for the delivery because it was a legitimate emergency.

On the other hand, James, a diabetic patient from Illinois, went for insulin refills in Wisconsin’s urgent care. His complaint was denied since it was not an emergency and he was supposed to return home for normal treatment by his state.“Medicaid coverage for emergencies” The above examples give you reasons why you should know the regulations prior to traveling.

Preparing Before You Travel

If you are dependent on Medicaid, planning is necessary prior to exiting your state. Always check hospitals in your destination and see if they accept out-of-state Medicaid patients. Keep your Medicaid ID, contact numbers, and a copy of your medical history handy in case of an emergency.

You also need to talk to your caseworker before you go on a trip. He or she can inform you if your state has exceptions, border compacts, or preapprovals. This easy action can save you stress if you have a medical crisis when you are away from home.

FAQ”s

Will Medicaid cover urgent care visits out-of-state?

Only if the visit meets the emergency definition. Regular urgent care visits are usually not covered.

What happens if I get sick on vacation but it is not an emergency?

You will likely have to pay for care out-of-pocket unless your state has special agreements.

Can I see a specialist in another state with Medicaid?

Yes, but only if your state approves it in advance and no provider in your state offers that service.

Does Medicaid cover emergencies in all 50 states?

Yes, federal law requires coverage for emergencies anywhere in the United States.

What should I do after an emergency treatment out-of-state?

Contact your Medicaid office, keep all documents, and ensure the provider bills Medicaid correctly.

Conclusion

So, Will Medicaid Cover Out-of-State Emergencies? The answer is yes, but only if it is a true emergency. Medicaid policies protect you in life-or-death crises anywhere in the United States. But routine or non-emergency care is readily denied.“Medicaid coverage for emergencies” Travelers must be ready, have the right documents, and follow up with Medicaid offices after they’ve been treated. If you know about them, you will avoid costly surprises and be covered on your holiday.