Does insurance cover ambulance? A complete guide to ambulance coverg Folks like to wonder this in a medical emergency. Ambulance ride can be expensive, and it is good to know what your insurance pays for. Through this guide, you will learn how billing works, how insurance typically pays, and how to stay oblivious to surprises.

We’ll cover private insurance, Medicare, Medicaid, non-emergency vs. emergency transport, and tips on how to save money. When you’re done, you’ll understand exactly what to do so that your ambulance ride won’t cost you a fortune.

How Ambulance Billing Works

Ambulance billing may be complex. Does Insurance Cover AmbulanceThe ambulance business bills, but sometimes the hospital pays part of it. Does insurance cover ambulance? A complete guide to ambulance coverg Charges include a fee, mileage, medical equipment used, and staff fees. Payment can vary depending on the type of ambulance—ground or air.

For example, a standard ground ambulance can cost $400 to $1,200. An air ambulance can cost tens of thousands of dollars. Some of it is typically covered by insurance, but whether or not you pay the remaining amount depends on your insurance policy. Fees may also differ if the ambulance is in-network or out-of-network.

| Type of Ambulance | Average Cost | Insurance Coverage Notes |

| Ground | $400-$1,200 | Usually covered if medically necessary |

| Air | $15,000-$50,000 | Often limited; high out-of-pocket possible |

Health Insurance Basics for Ambulance Coverage

Ambulance coverage is the most health care plans pay if medically necessary. This is when your life or health would be at risk if not admitted right away.Does insurance cover ambulance? A complete guide to ambulance coverg Your coinsurance, deductibles, and copays are still due.

Insurance might only cover in-network providers.Does Insurance Cover Ambulance If your driver is out-of-network, balance billing might be applied to you. That is why reading your policy and being informed of your rights is necessary.

CHEAK:https://doctorambulance.com/how-much-is-an-ambulance-ride-with-insurance/

Always verify whether your plan does pre-authorization for non-emergency rides.

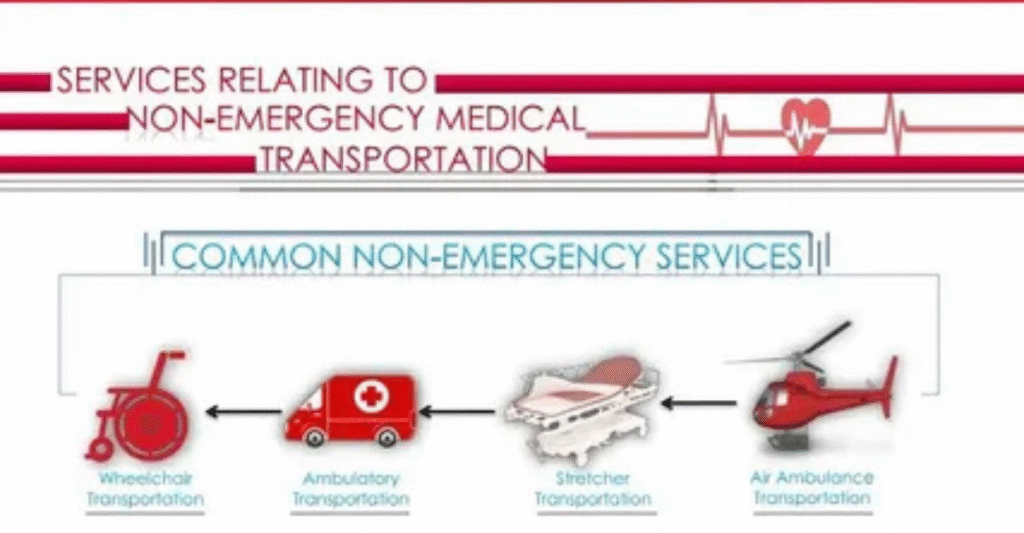

Emergency vs. Non-Emergency Transport

Emergency transportation is when minutes count. Severe trauma, heart attack, or stroke are such examples. Insurance covers these rides in full, except for your copay or deductible.

Non-emergency transport is different. It could be moving patients from hospital to hospital or to dialysis. Does Insurance Cover Ambulance Coverage generally depends on documentation of medical necessity. If the ride in the ambulance is considered an extravagance, the claim will be rejected by insurance.

Private Health Insurance Policies

Private insurers differ in coverage for ambulance rides. They can pay for in-network rides only, or they can pay for some of the out-of-network rides. Pre-authorization can be used for non-emergency transportation.

Patients usually have balance billing. For example, you get charged $600 for an ambulance, your insurer pays $400, and you pay $200.Does insurance cover ambulance? A complete guide to ambulance coverg Always confirm coverage beforehand and make copies of all medical records.

Government Programs: Medicare & Medicaid

Medicare Part B pays for ambulance services if they are medically required. Ground or air transportation to a proper, closest hospital is generally covered. Medicare does not pay for convenience rides or preferred hospitals.

Medicaid policies are different in every state. Some states mandate approval beforehand. Medicaid typically pays for emergency transport in full. Does Insurance Cover Ambulance Non-emergency rides could need documentation and approval to process payments.

| Program | Coverage | Notes |

| Medicare Part B | Emergency ambulance | Must be medically necessary |

| Medicaid | Emergency and some non-emergency | State rules apply |

| Private Insurance | Varies | Check in-network vs out-of-network |

Air Ambulance Coverage

Air ambulance trips are substantially more expensive than ground travel. Flights can be as much as $30,000. Insurance companies generally review air ambulance claims and require proof of necessity.

Several arguments arise as to whether air transportation was indeed necessary. Does Insurance Cover Ambulance For example, transporting a patient by air 10 miles when it could be done with a ground ambulance can result in denial of a claim. Always document medical urgency to prevent denials.

Common Exclusions and Limitations

Convenience transportation is not typically covered under insurance. This includes trips to your preferred hospital, home, or regular visits. Out-of-network ambulance trips also lead to unexpected bills.

They suspend some policies when they deny non-emergency transport when previous approval was not sought. State law may shield you from such unexpected bills, but check your policy.

How to Verify Your Coverage

Contact your insurance company before any planned transport. Find out if your policy covers emergency and non-emergency transports, as well as whether your ambulance provider is in-network. Obtain written confirmation if possible.

Also, read through your insurance booklet. Does Insurance Cover Ambulance Locate the page that deals with ambulance services. Make sure to study terms like deductible, coinsurance, and “medically necessary.” Being proactive can save you thousands.

What to Do if a Claim Is Denied

First, ask your insurer why. Obtain medical records, physician notes, and ambulance reports. Appeal promptly. Some patients call the ambulance company and negotiate lower bills up front.

If so, contact your state insurance department. They can help enforce “No Surprise Billing” protections. Determination is often rewarded, as an extremely high percentage of initially denied claims are granted upon appe

CHEAK:https://doctorambulance.com/how-much-is-an-ambulance-ride-with-insurance/

Tips to Lower Out-of-Pocket Costs

In-network ambulances are most crucial. Non-emergency transportation could be covered under member programs. Even air ambulance costs can be helped with by supplemental insurance

Patients are protected from balance billing by state law in emergencies. Know your rights, save records, and always check coverage before non-emergency visits.

Key Takeaways

Ambulance coverage isn’t the same for everyone, and it often depends on your insurance plan and the type of transport needed. Emergency ambulance rides are usually covered, but non-emergency trips may require prior approval or may not be included at all.

Always review your policy details to understand what’s covered and what costs you might face. Knowing this in advance can save you from surprise bills and help you make quicker, stress-free decisions in an emergency.

Average Ambulance Costs by Type

| Type | Average Cost | Notes |

| Ground | $400-$1,200 | Usually covered if emergency |

| Air | $15,000-$50,000 | Often partially covered; high out-of-pocket |

Insurance Coverage Comparison

| Insurance Type | Emergency | Non-Emergency | Pre-Authorization Needed |

| Private | Covered | Sometimes | Often |

| Medicare | Covered | Rarely | Yes |

| Medicaid | Covered | Sometimes | State-dependent |

Common Denial Reasons

| Reason | Example |

| Not Medically Necessary | Transport for convenience |

| Out-of-Network | Ambulance not in your plan’s network |

| Lack of Documentation | Missing doctor notes for non-emergency transport |

FAQ”s

Does insurance ambulance minor injuries?

Most plans do not cover non-emergency rides unless a doctor certifies medical necessity.

Are air ambulances covered?

They may be partially covered, but insurers require proof of urgency.

What if ambulance out-of-network?

You may owe the balance. Check your plan and state protections.

Can Medicaid non-emergency transport?

Yes, but rules vary by state and often require prior approval.

How do I appeal a denied ambulance claim?

Collect medical records, submit documentation, and follow your insurer’s appeal process.

Conclusion

Knowledge of does insurance covers ambulances can protect you from staggering bills. Emergency transports are generally covered, but non-emergency transport usually requires approval. Always review your policy, question, and record your medical necessity. With planning, you can lower out-of-pocket expenses and prevent surprises. Having knowledge of your coverage provides peace of mind when every second matters.