How Much Does an Ambulance Ride Cost With Insurance is a query most individuals only make after experiencing an unexpected emergency. The fact remains that ambulance charges are surprising even with insurance. Charges vary based on where you reside, the nature of transport, and whether the ambulance service is in-network or not.

The cost of ambulance ride can be hundreds, thousands, and so on. Here, you will find the average charges, how insurance works, and why many are still stuck with high bills despite their coverage. Knowing these things, you plan ahead of time before disaster strikes

Average Cost of an Ambulance Ride in the U.S.

An ambulance ride in America can be expensive. A ground ambulance will run on average from $400 to $1,200. In larger cities or rural settings where distances are great, that figure can very quickly escalate. Without insurance, it’s as high as $3,000 or more depending on services.

Air ambulance flights are expensive. A helicopter flight can range from $10,000 to $40,000For medical flights over long distances, the charge can be over $50,000. These high costs indicate why it is necessary for every family to learn the cost of an ambulance ride with insurance.

| Type of Ambulance | Average Cost (Without Insurance) | Average Cost (With Insurance) |

| Ground Ambulance | $400 – $1,200 | $100 – $500 |

| Air Ambulance | $10,000 – $40,000 | $2,000 – $10,000 |

How Health Insurance Covers Ambulance Services

When you have insurance, some of your ride in the ambulance is normally paid for. But again, it is up to your policy. Most policies pay for emergency ambulance transport if it is medically indicated. This implies that the trip needs to be necessary in order to save your life or health.

You must still pay your deductible, copay, or coinsurance. For instance, if your deductible is $1,500, you might have to pay that out-of-pocket before insurance kicks in. If the ambulance service is out-of-network, your portion will be more. This is why ambulance ride with insurance cost can still be high.

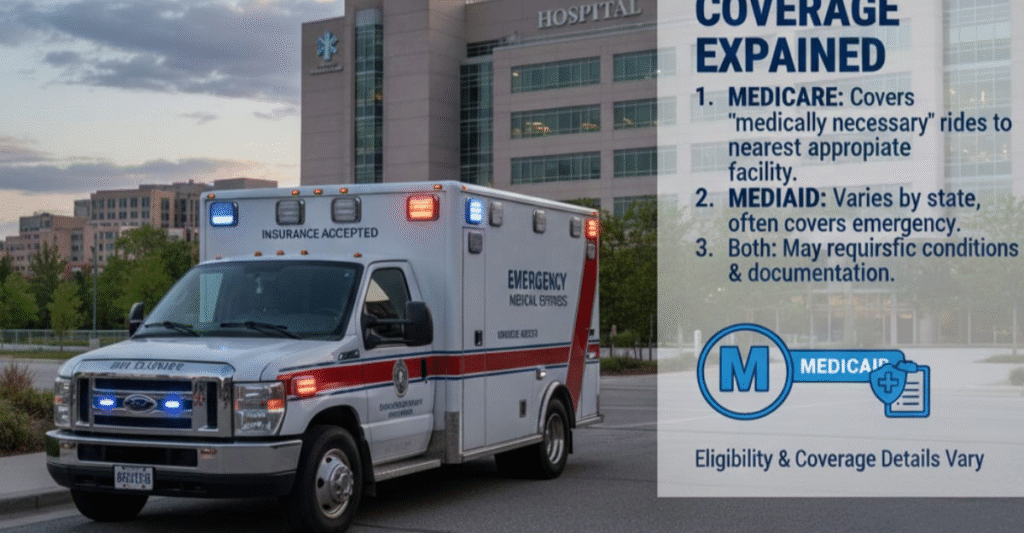

Medicare and Medicaid Ambulance Coverage Explained

Medicare Part B pays for rides in an ambulance if other travel would put your health at risk. It covers 80% of the cost approved after deductible. You might owe around 20% of the charge yourselfMedicare only covers non-emergency rides if your doctor writes a note indicating that they are medically necessary.

Medicaid coverage differs across states. Some cover both emergency and non-emergency conditions, whereas others do not. Many times, the patients pay nothing out-of-pocket. Knowledge about the Medicare and Medicaid Exchange coverage will avoid the seniors and poor families from incurring unnecessary expenses.

Out-of-Network Ambulance Bills and Surprise Charges

One significant problem is that most ambulance companies are out-of-network.Even if your hospital is in-network, the ambulance may not be. This leads to balance billing, where the ambulance company bills you the difference between what insurance pays and their fee.

Surprise ambulance bills do not come as a surprise. According to research, more than half of emergency ambulance rides result in out-of-network billing. Although the No Surprises Act protects patients from the majority of surprise emergency medical billing, ground ambulance rides are not protected to the same degree.This leaves countless families drowning in surprise debt.

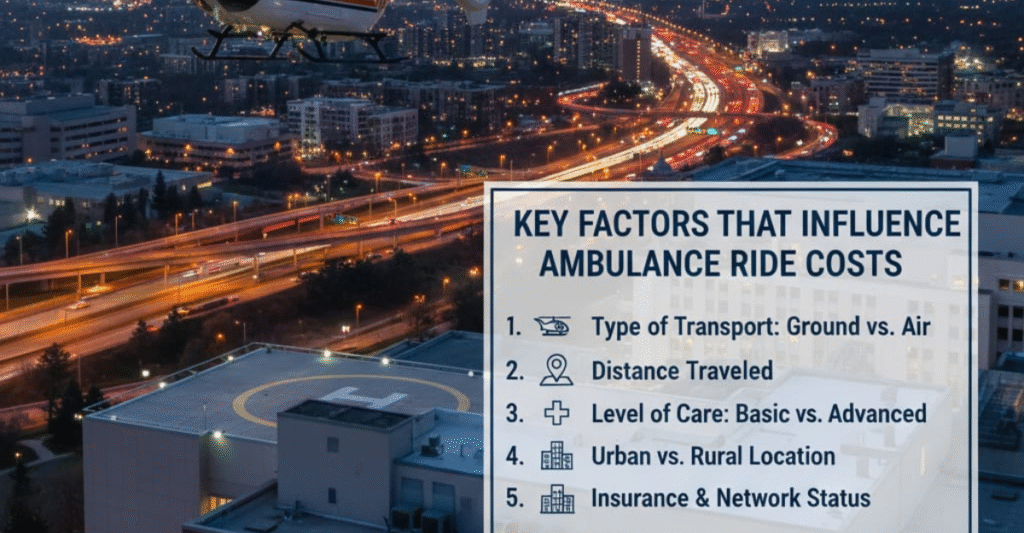

Key Factors That Influence Ambulance Ride Costs

There are many factors that determine the cost of your ambulance trip. The distance is a major one because ambulance companies bill for miles. A short city trip could be less than $500, but a lengthy rural trip could be over $2,000.

The condition you’re in also alters the bill. If oxygen, IV fluids, or advanced life support are provided by paramedics, it costs more. Where you are also impacts the price. Urban ambulance service typically costs more than rural ambulance service due to increased operating costs. These factors behind ambulance ride costs explain why two individuals might pay significantly more for the same rides.

Air Ambulance Costs with Insurance vs. Without

Flights by air ambulance are one of the most expensive medical interventions. A helicopter ride might be tens of thousands of dollars. With insurance, you may still have to pay thousands depending on your policy. If it’s out-of-network care, the bill is potentially crippling.

Insurance will usually only cover air ambulance if there’s no other transportation safe. As a for instance, if a rural patient needs urgent care to an out-of-the-way trauma center, insurance can authorize it. Non-emergency air ambulance transport, however, is not generally covered. Understanding air ambulance cost with insurance avoids huge bills later on.

| Service Type | Average Cost | Insurance Coverage | Patient Cost (Average) |

| Helicopter Emergency | $20,000 – $40,000 | 60% – 80% | $2,000 – $10,000 |

| Fixed-Wing Aircraft | $30,000 – $60,000 | 50% – 70% | $5,000 – $20,000 |

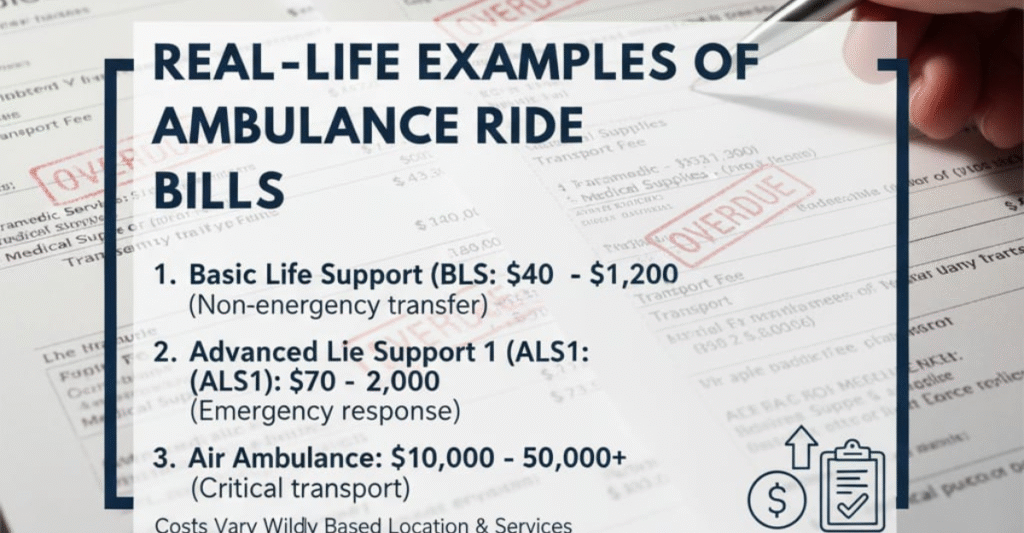

Real-Life Examples of Ambulance Ride Bills

Case studies illustrate the differences in ambulance bills. One patient in Texas rode 15 miles for chest pain. The bill came to $2,200. Insurance covered $1,500, and the patient paid $700 out-of-pocket.

The second case was a helicopter ride for a victim of a car accident in California, which cost $35,000 total. The insurance company paid $25,000, yet since the provider was out-of-network, the patient still had $8,000 to pay. These instances illustrate that ambulance ride with insurance is not always inexpensive and that patients need to know their plan.

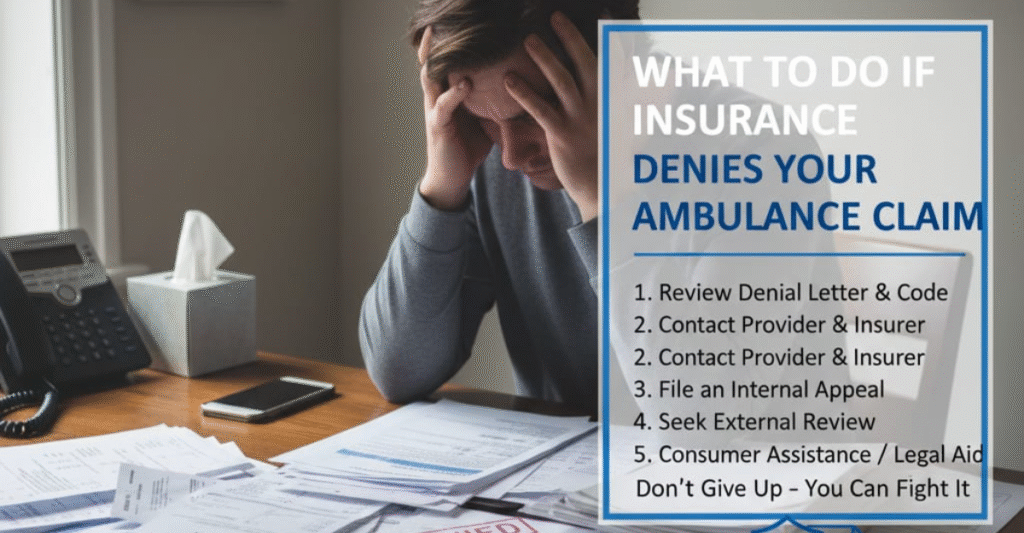

What To Do If Insurance Denies Your Ambulance Claim

If your insurance company refuses payment for the ambulance ride, you may appeal. You do this by mailing forms from your doctor that describe why the ride was necessary for medical reasons. Occasionally, the insurance companies reverse their decision after they review it.

If still, you are left with a huge bill, you may attempt negotiation directly with the ambulance company. Payment plans or discounted fees for hardship are some offers made by certain companies. Patients must also

Tips to Reduce or Avoid High Ambulance Charges

Steps to minimize surprise ambulance bills can be taken by you. First of all, familiarize yourself with your insurance policy. Find out if it includes emergency as well as non-emergency transport and if the local ambulance company is in-network.

In non-emergency cases, take alternative transport. Some hospitals have medical vans or ride-sharing services for stable patients. Always query the hospital personnel if another alternative is

| Action | Benefit |

| Check coverage before emergencies | Know your out-of-pocket costs |

| Ask about in-network ambulance | Reduce risk of surprise billing |

| Consider non-emergency transport | Lower cost compared to ambulance |

| Negotiate bills | Possible payment reductions |

Final Thoughts on Ambulance Costs with Insurance

Ambulance transportation is expensive even if you have insurance. The cost is ultimately based on your insurance coverage, the provider you go to, and the services you receive. Ground ambulance transportation might be partially affordable, but air ambulance transportation tends to result in huge bills.

The greatest protection is to know your coverage prior to a crisis. Ask questions, examine your policy, and get prepared when you can. Knowledge can help you save thousands of dollars when you don’t anticipate it.

Average Cost of an Ambulance Ride in the U.S. (Expanded)

The cost of ambulances in the United States is among the highest in the globe. It is not determined by the national level but by individual companies, hospitals, or local government entities. That is why the person in California might pay twice the amount that the person in Ohio will pay for an equivalent emergency trip.

Per health cost studies, the average fee for a ride in an ambulance in the US is about $1,200. But since bill structures have a base fee plus mileage plus medical equipment, the bills can escalate rapidly. A ride that takes five miles with basic care can be $700, but a ride for twenty miles with oxygen and IV therapy can exceed $2,500.

How Health Insurance Covers Ambulance Services (Expanded)

Each health insurance provider determines its own conditions for coverage of ambulances. Private health policies generally include ambulance services as emergency medical benefits. That is, your policy ought to cover you if you were having a genuine emergency.

But the insurer will later examine the claim to determine whether the ride was “medically necessary.” If they determine that it was not necessary, they will deny coverage. For instance, if you experienced mild pain but requested an ambulance rather than a car ride to the hospital, your insurer can deny payment. This leaves the patients footing the bill.

FAQ”s

How much is the average ambulance copay with insurance?

The average copay ranges from $50 to $250 depending on your plan. Coinsurance may add extra costs.

Does Medicare fully cover ambulance rides?

No. Medicare Part B covers 80% after your deductible. You usually pay 20% out of pocket.

Are ambulance rides free if you don’t request them?

No. Even if you did not request it, you are billed for transport unless insurance covers it fully.

Why are ambulance services often out-of-network?

Many ambulance providers do not sign contracts with insurers. This causes higher

What’s the difference in cost between ground and air ambulance?

Ground rides may cost $400–$1,200. Air ambulance rides often exceed $20,000 even with insurance.

Conclusion

How Much Does an Ambulance Ride Cost With Insurance is highly dependent on many variables such as location, transport method, and insurance. Ground ambulance transportation can set you back hundreds, and air ambulance flights thousands. Medicare, Medicaid, and private insurance aid are available but surprise billing is frequent. Understaning your coverage and preparation beforehand can limit the potential for expensive bills Knowing the cost of ambulance ride with insurance not only makes sense but also is necessary for financial security.